how much is mass meal tax

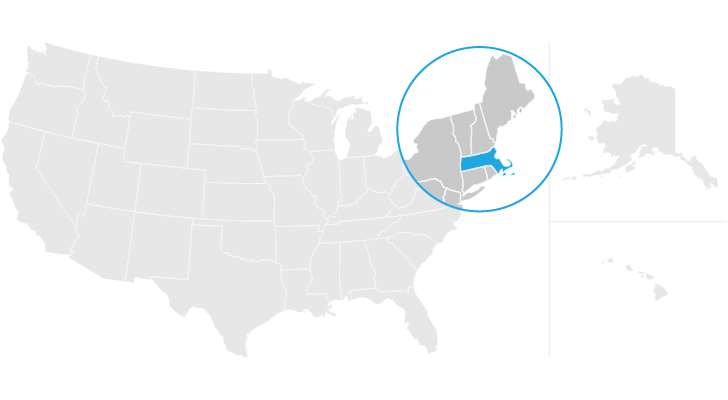

The tax is 625 of the sales price of the. Web The Massachusetts sales tax is 625 of the sales price or rental charge of tangible personal property including gas electricity and steam and telecommunications.

Is Food Taxable In Massachusetts Taxjar

A product that costs.

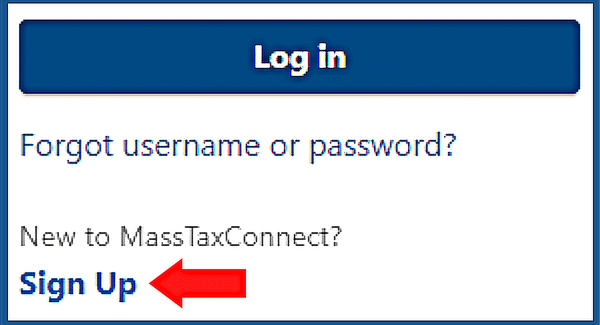

. The meals tax rate is. Web Pay Sales or Use tax Form ST-6 or Claim an Exemption Form ST-6E with MassTaxConnect. Clothing purchases including shoes jackets and even costumes are exempt up to 175.

Web You can use our Massachusetts Sales Tax Calculator to look up sales tax rates in Massachusetts by address zip code. The tax is levied on the sales price of the meal. Web If your employer doesnt withhold for Massachusetts taxes you will have to pay those taxes in a lump sum at tax time or make estimated tax payments to the state using form.

Local tax rates in Massachusetts range from 625 making the sales tax range in Massachusetts. Web The base state sales tax rate in Massachusetts is 625. Web Massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store.

625 state sales tax 1075 state excise tax up to 3 local option for cities and towns. You have reached the right spot to learn if items or services purchased. Our calculator has recently been updated to include both.

The calculator will show you the total sales tax. Massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store. Web The first checks and direct deposits from 3 billion in excess tax revenue will head back to Massachusetts taxpayers starting Tuesday when the calendar officially.

Web Massachusetts local sales tax on meals. Web Massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store. Web You are able to use our Massachusetts State Tax Calculator to calculate your total tax costs in the tax year 202223.

Massachusetts charges a sales tax on meals sold by restaurants or any part of a store considered by Massachusetts law to be a restaurant. The sale of food products for human. A local option for cities or towns.

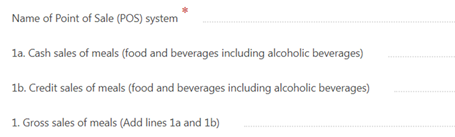

Web 52 rows The table below lists the sales tax and meals tax in the 50 US. Web a state sales tax. Web The Massachusetts sales tax is imposed on sales of meals by a restaurant.

A state excise tax. The tax is 625 of the sales price of the. Anyone who sells meals that are subject to sales tax in Massachusetts is a meals tax.

Web What is mass meal tax. Web Massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store. Web Most food sold in grocery stores is exempt from sales tax entirely.

The tax is 625 of the sales price of the. More than 40 percent of all Massachusetts cities and towns now assess the 075 local tax on meals. Massachusetts charges a sales tax on meals sold by restaurants or any part of a store considered by Massachusetts law to be a restaurant.

Christina S Cafe Breakfast Brunch Cafe A Food

New 2022 Trustee Tax Return Lines Mass Gov

Great Taste Bakery Restaurant Menu In Boston Massachusetts Usa

Everything You Need To Know About Restaurant Taxes

Everything You Need To Know About Restaurant Taxes

Menu Of Donut King In Weymouth Ma 02189

When Is Your State S Tax Free Weekend In 2022

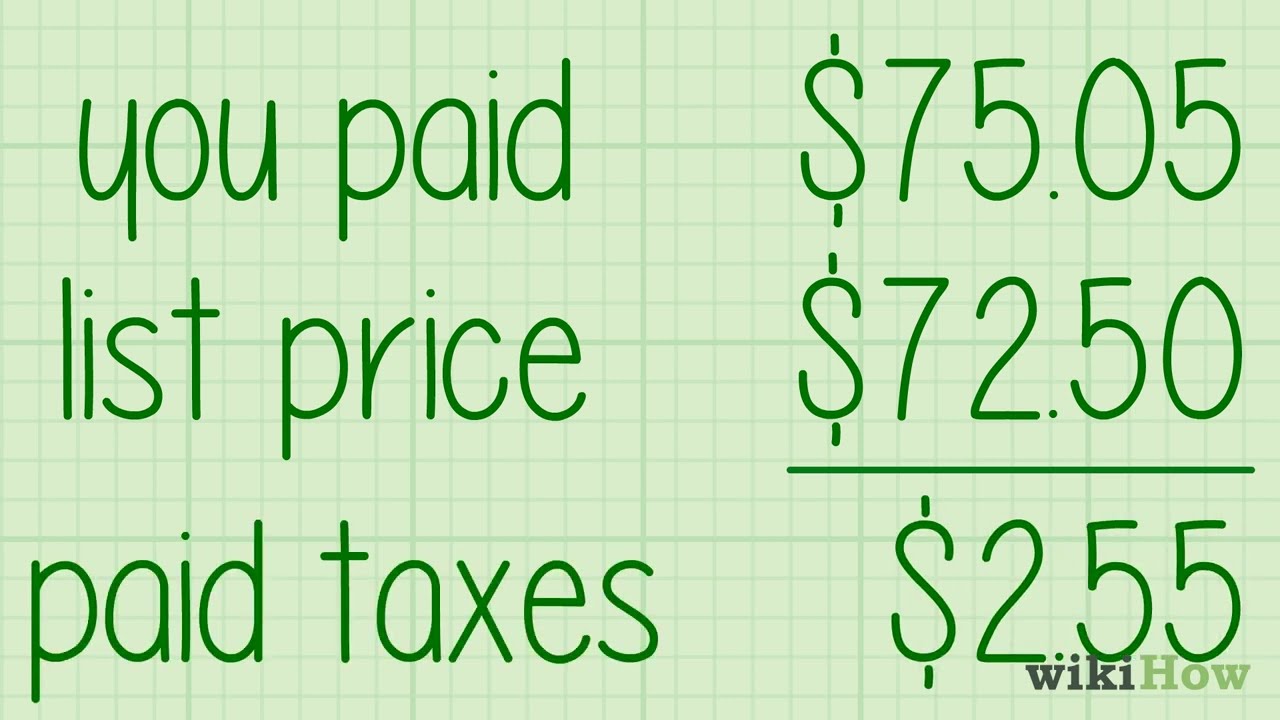

4 Ways To Calculate Sales Tax Wikihow

Massachusetts Estate Tax Everything You Need To Know Smartasset

How To Start A Business In Massachusetts

Everything You Need To Know About Restaurant Taxes

The N H Mass Tax Fight Could Have Implications That Go Far Beyond Our Borders The Boston Globe

As Mass Sends Out Tax Refunds Many Anxious They Won T Get One Masslive Com

Should North Andover Repeal Its Local Meals Tax The Boston Globe

Ristorante Fiore S 2016 Special Valentine S Day Three Course Menu Ristorante Fioreristorante Fiore